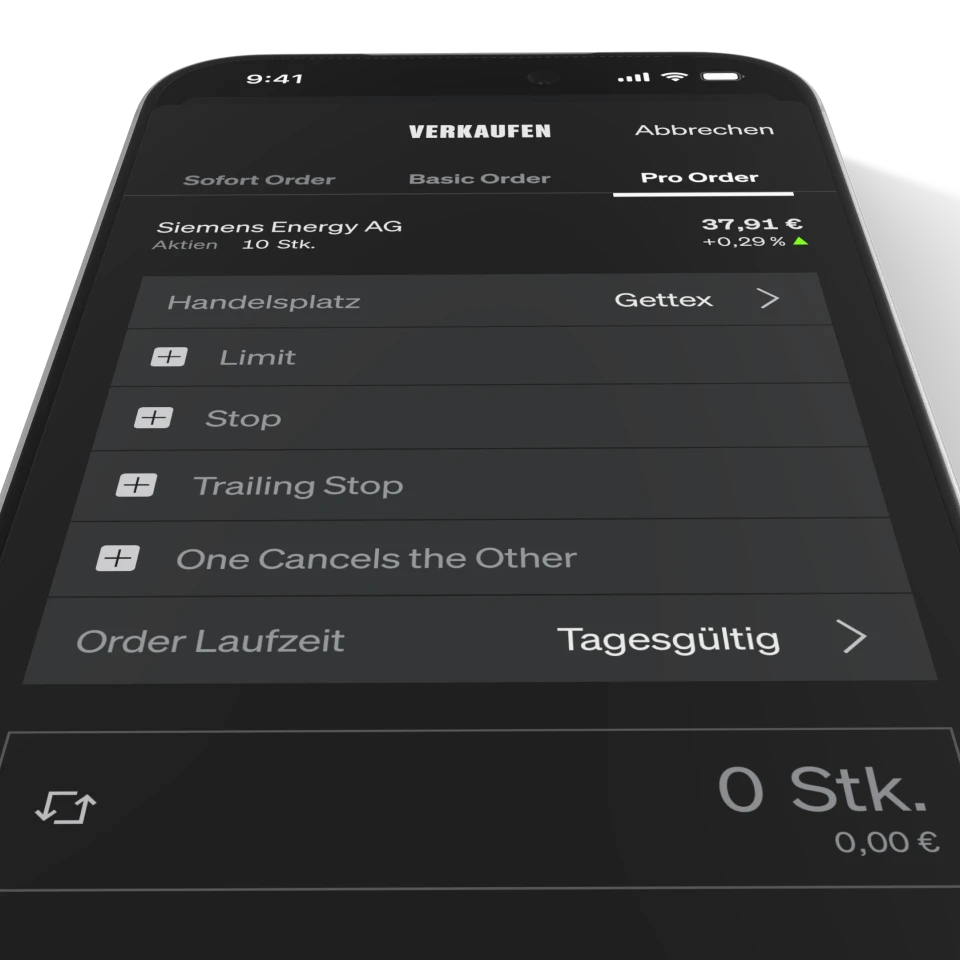

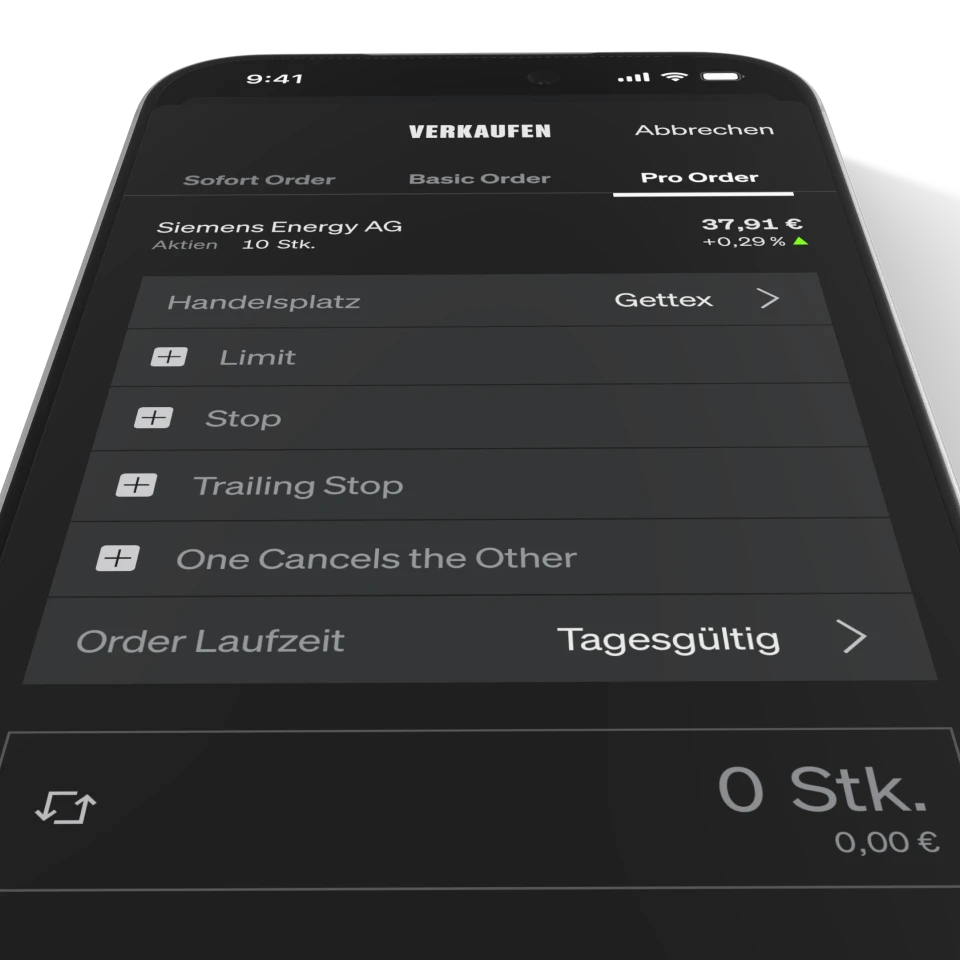

Multiple order types

Designed and beta-tested order types like Trailing Stop Loss and One Cancels the Other.

I’m currently leading the design team at Smartbroker AG, working on SMARTBROKER+.

SMARTBROKER+ is a German neobroker that combines full-service brokerage with the speed and simplicity of modern trading apps.

My team covers the full spectrum of product design, from research and UX strategy to interface design and user validation.

Beyond hands-on design work, I’ve established workflows that allow the product team to make user-centered and data-based decisions.

Designed and beta-tested order types like Trailing Stop Loss and One Cancels the Other.

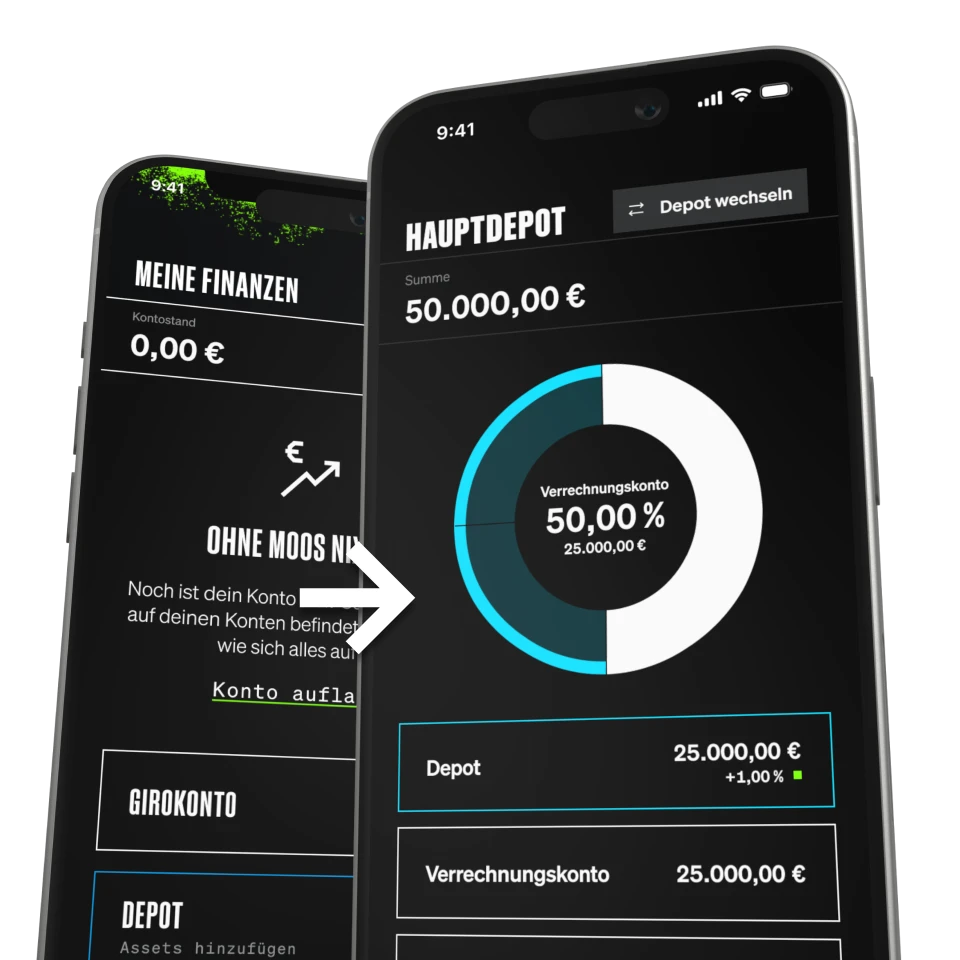

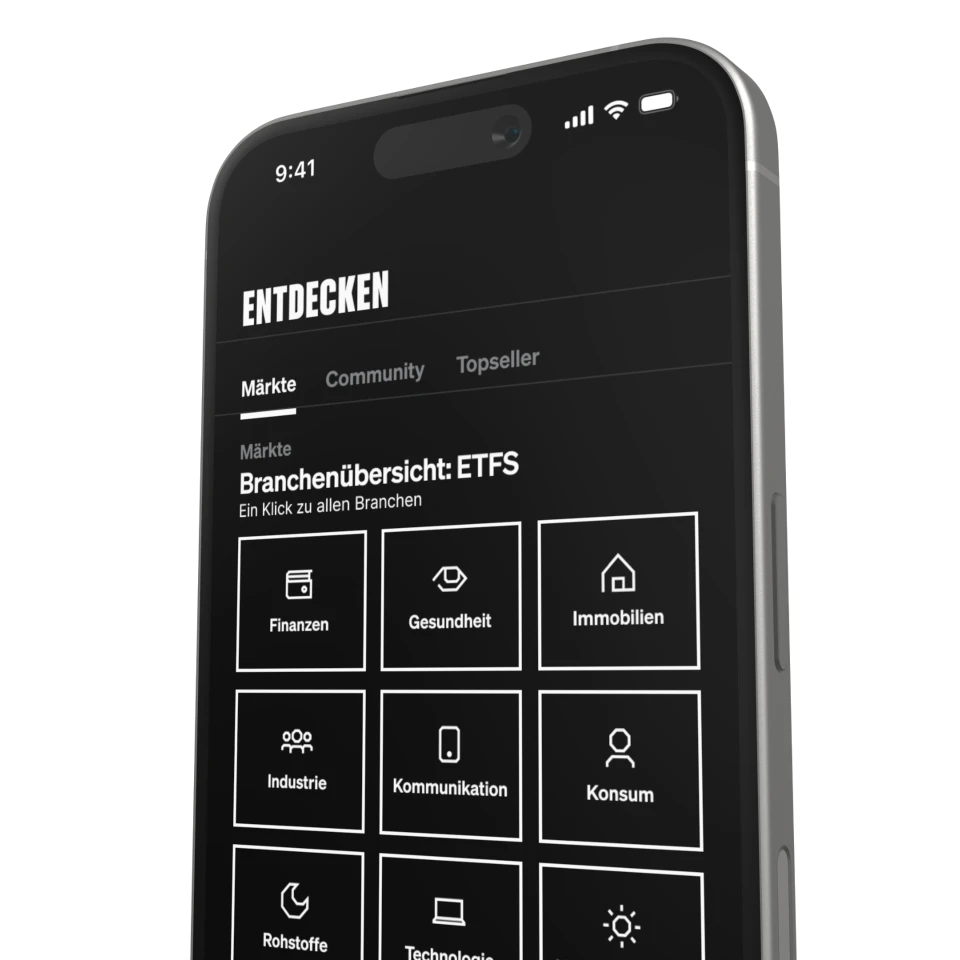

Lead the rebrush project to re-fit our design & image to our target group.

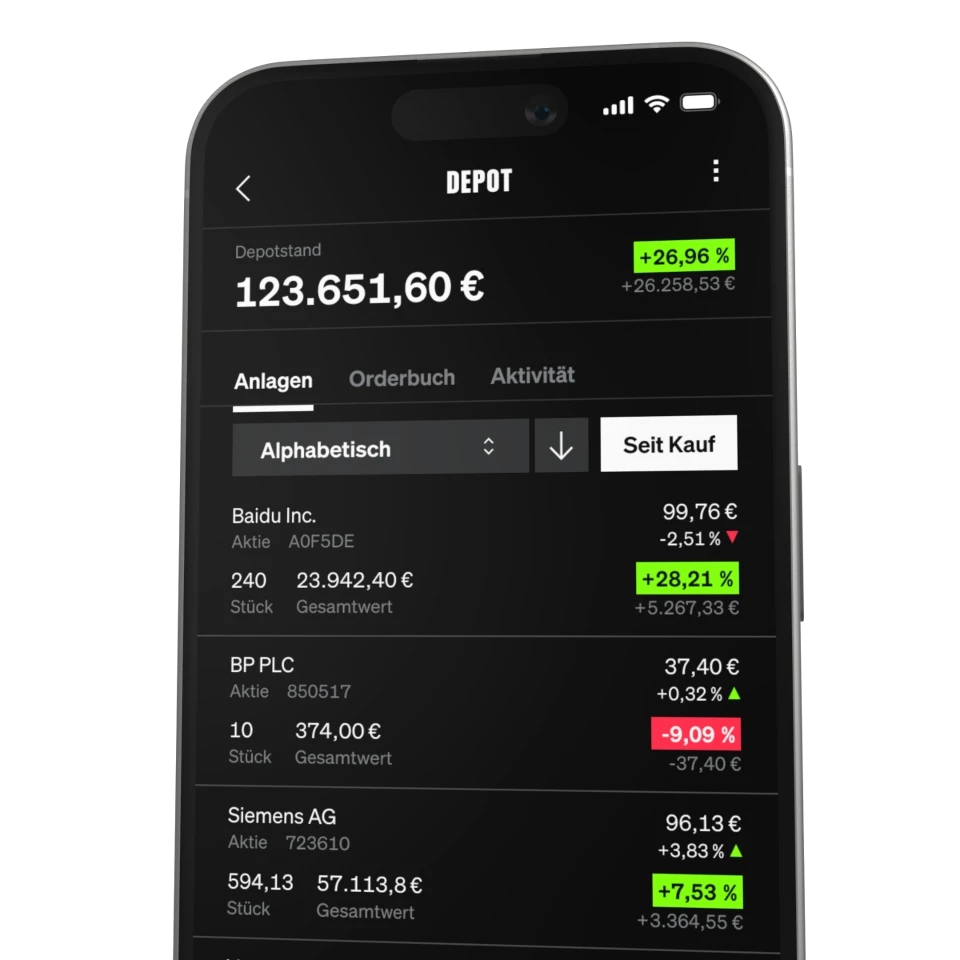

Responsible for re-thinking the entire depot view, including sorting and items.

Worked on multiple UIs for offering tax options to customers, like FSA.

Lead a push to a new contact form to shrink load on our customer support.

Pushed & lead a depot export feature based on VOC customer requests.

Responsible for user interviews, usability testing, and a large beta test.

Conducted user interviews, usability tests and internal & public beta tests.

Designed the entire UI and tested with users on multiple platforms.

Great, then you should definitely apply to work with us.

You can always check on our Careers page if there’s an opening that might fit you.

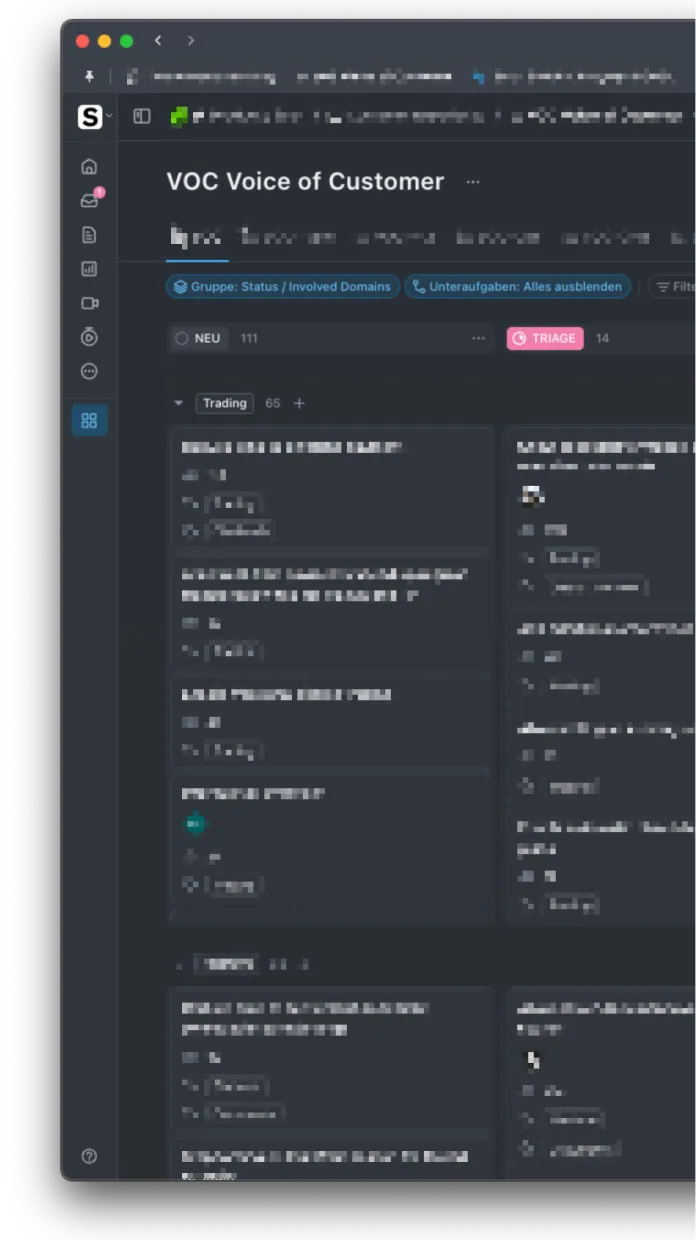

VOC serves as our central hub for gathering, structuring, and analysing user feedback. It brings together insights from several sources:

This mix allows us to identify recurring themes and pain points with a level of precision that pure analytics can’t provide.

Beyond quantitative data, VOC also captures qualitative research. That combination helps us understand not just what users are saying, but why they feel that way and what specifically they want when asking for new features or improvements for existing ones.

Over time, VOC has become an integral part of how we plan and prioritise our roadmap. It ensures that design and product decisions stay grounded in real user needs rather than assumptions or internal preferences.

Titled Trading in the capital casino - How design can act as an influencer on the capital market, I investigated the influence user interfaces have on risk behaviour in modern trading apps.

My thesis was simple and yet very hard to prove: Modern neobrokerage interfaces lead their users into taking risks—meaning trades—by using interface methods, for example gamification.

Unfortunately, the thesis is protected by an NDA until March 2026, but here’s the abstract:

“This master thesis investigates the influence of interfaces on the risk behavior of investors in modern trading apps. The design of the interfaces of neobrokers can lead investors to passively execute trades that do not fit their investment strategy. A combination of the increasing popularity of neobrokers and the fundamentally growing interest in the capital market creates a potential influence on the risk behavior of many millions of investors.

To answer the research question about the potential influence, an analysis of seven trading apps of neobrokers available on the German market was conducted. A following comparison shows a discrepancy between the information offered in trading apps and the information actually needed for healthy and conscious trading.

The results show that, through the use of gamification and other design methods, investors are passively enticed to adopt riskier trading behaviors than their investment strategy envisages. The lack of hurdles before buying a security results in investors not having the opportunity to think through and consciously make an investment strategy.

As a proposed solution, seven design drafts were created in the form of click prototypes that use friction to create a hurdle for conscious action. In usability tests with test persons from the target group, four designs are identified that can demonstrate a concrete influence on the risk behavior of investors.

These designs can be a basis for interface models that focus on the legally required consumer protection for capital investors. The designs can also be used in particularly vulnerable contxexts on the capital market, such as junior custody accounts.”